Which of the Following Statements About Startup Capital Is False

Management accounting system cannot be installed without financial and cost accounting system. Forecasting is relatively unimportant for early-stage ventures with little historical financial data d.

Emerge App A One Stop Inventory Management Solution Inventory Management Software Management Inventory Management

C Partnerships cannot be formed for altruistic or benevolent purposes.

. Which of the following statements about venture capital firms is false. D A person can be a partner even if. A A partnership only comes into existence once it starts trading.

Most start-up companies that acquire venture capital eventually turn out to be successes. Both A and B. Venture capital firms are usually organized as a.

A Startup firm B University C Fortune 500 firm D Midsize manufacturer E Consulting firm. Which of the following statements is FALSE. The type of capital resources that a startup business needs to begin operating usually depends on the A.

Risk of cash insolvency. Based on statistics reported in the text which of the following statements is FALSE. B A partnership created for a one-off transaction will cease after that transaction is complete.

Firms that obtain venture-capital funding receive an average of over 1 million each. Which of the following statements about startup capital is FALSE. Total investment in start-up firms averages about 80000 in the firms first year.

Depreciation is the allocation of the cost of a capital asset over time -- as it wears out or depreciates in value. Startup capital is money you invest in the form of supplies marketing legal services and other investments to get your business up and running. The holding period of a capital or profits interest begins on the date the interest is received.

B Venture capitalists typically control all of the seats on a start-ups board of directors and often represent the single largest voting block on the board. A A venture capital firm is a limited partnership that specializes in raising money to invest in the private equity of young firms. Forecasting sales is the first step in creating projected financial statements b.

Extension of seed capital. Finance questions and answers. The scope of management accounting is wider than that of cost accounting.

When an entrepreneur seeks a high profit the risk is usually higher. Financial forecasting tends to be more accurate for mature ventures than for early-stage ventures c. All anticipated cash coming into or going out of the firm as a result of a capital investment should be used in capital budgeting decisions.

Which of the following statements about startup capital is false. The following factors influence the capital structure decisions. Which of the following is a function of SIDBI.

Which of the following statements is TRUE about startup capital. Along with capital _____ is the primary production input that the organization uses to create products and services. B Take home pay is the amt.

Which of the following is an example of a divisionalized bureaucracy. The majority of Entrepreneurial firms are financed by Venture Capital firms. Which of the following statements regarding capital and profit interests received for services contributed to a partnership is true.

SFC is prohibited from granting financial assistance to any company whose aggregate paid-up capital exceed_____. A A venture capital firm is a limited partnership that specializes in raising money to invest in the private equity of young firms. Generally speaking the risk involved in launching as a franchise is greater than that as a start up.

Which of the following statements bat take home pay are FALSE. Identify which one of the following statements is NOT true. You earn each month in income Minus - what you save.

All of the above. 6 Which of the following statements is FALSE. Which of the following statements is incorrect.

Venture capital firms get most of their capital from pension funds large university endowments and other institutions that can take substantial risks with a small portion of their funds. Closed-end mutual funds b. Startup capital is the money you spend in order to create a balanced budget for your personal finances.

Management accounting assures maximum return on capital employed. Startup capital is the money you invest in the form of supplies marketing legal services and other investments to get your business up and running. Traditional bankers never lend to start-up firms.

The management accountant is a member of management team. Risk of cash insolvency arises due to failure to pay fixed interest liabilities. QUESTION 1 20 p Please decide whether or not the following statements are true or false a.

Which of the following statements about startup capital is FALSE. B Venture capitalists typically control about three-quarters of the seats on a start-ups board of directors and often represent the single largest voting block on. Startup capital is the money.

Among the 100 fastest-growing new businesses identified by Entrepreneur magazine 61 percent obtained start-up funding. Partners receiving capital interests must recognize the liquidation value of their capital interests as. You earn each month in income Minus- what you spend.

Both a and b n either a nor b. D All the Above A Take home pay is the mat. Which of the following statements is true about new venture risk-taking.

A structure B culture C politics D feedback E labor. A and b. Generally the higher proportion of debt in capital structure compels the company to pay higher rate of interest on debt irrespective of the fact that the fund is available.

Pin By Victor Shiguiyama On Info Tech Start Up Raising Capital How To Plan

World S Largest Professional Network Venture Capital Social Activities Brand Marketing

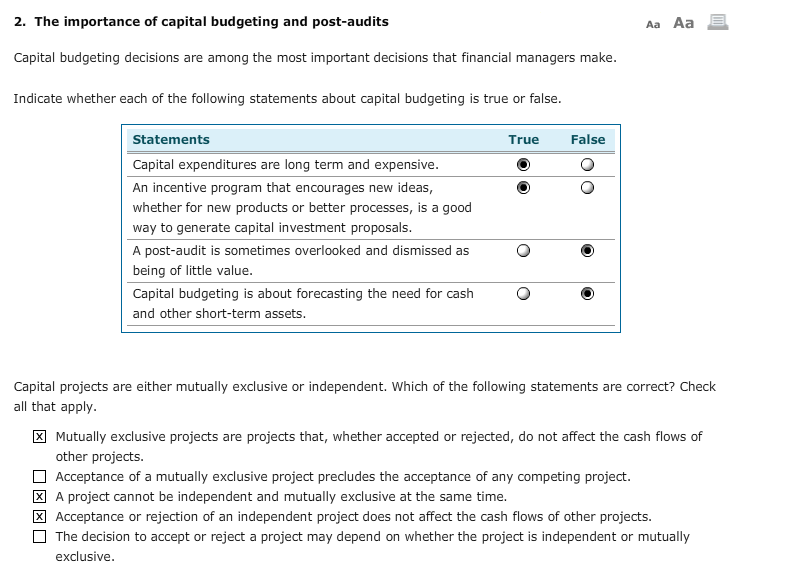

Solved Capital Budgeting Decisions Are Among The Most Chegg Com

Twitter Brentvosa 3 Psychological Traps That Start Up Startup Growth Chart

No comments for "Which of the Following Statements About Startup Capital Is False"

Post a Comment